is a car an asset or expense

Gas Mileage Log Form. Heres how to classify them.

Professional Company Car Allowance Policy Template Policy Template Templates Policies

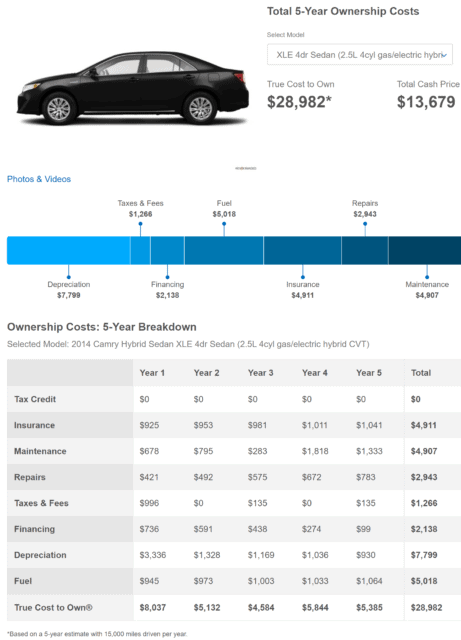

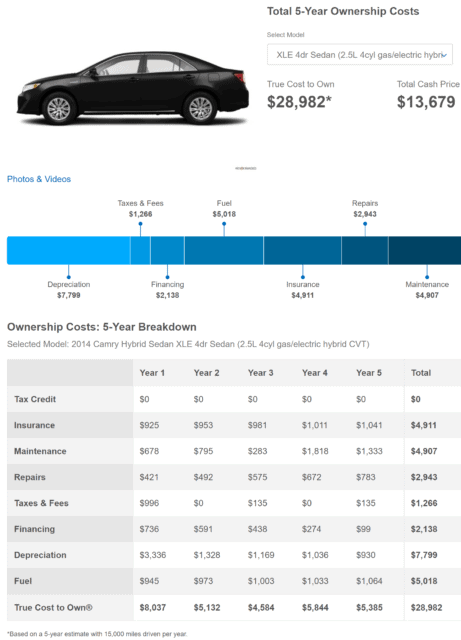

If the fully depreciated car continues to be used there will be no further depreciation.

. Although the revenue produced helps make up for this inevitability the fact remains that driving or renting out your car for extra income means your side hustles indispensable asset becomes less valuable at a comparatively rapid rate. When you declare business assets as an expense you usually get a larger. Get latest NAV Returns SIP Returns Performance Ranks Dividends Portfolio CRISIL Rank Expert Recommendations and Comparison with gold stockULIP etc.

You should also expect to include any extras that count as income when you file your taxesThis includes. If the purchase price of an asset is more than 2500 you have to claim it as an assetThat also means you need to track its depreciation. Calculating the Depreciation for a Vehicle.

Last Expense MEDICAL Cigna Global International Health Health Insurance. Your taxable income starts with your salary. GAP waives the difference between your primary auto insurance settlement and the outstanding balance owed on your vehicle on the date of loss.

If its purpose is primarily personal it is not considered a business expense. Calculate SIP VIP Returns. This is a detailed template that allows you to create a thorough expense report for accounting and record keeping.

Accounting Entries for a Fully Depreciated Car. High expense ratios can drastically reduce your potential returns over the long term. An asset is a resource with economic value that an individual corporation or country owns or controls with the expectation that it.

When it comes to expense the asset it provides you with the deduction in the. If the improvement relates to an existing asset in your small business pool you simply add the improvement cost to your pool as a cost addition amount along with costs incurred when disposing of or permanently ceasing to use an asset. Normally depreciation is deducted as an expense to the business over the life of the equipment or vehicle.

On random search I found two ways to execute the salary payment in quickbooks online. The maximum that can be deducted is 3160 in the 1 st year without the bonus depreciation 5100 in the 2 nd year 3050 and 3 rd year and 1875 in the 4 th and later years until the car is fully depreciated. Enter company and employee information at the top along with a time period and then keep track of mileage and other expenses for each day of the week.

Salvage value is the estimated value that the owner is paid when the item is sold at the end of its useful life. Also guide which is the best practice and the detailed steps of the same. By recording Expense and 2.

A business will not be able to deduct it and employees must pay tax on it as a benefit. Additionally the practical fact reveals that any asset think of buying a new car loses more its value in the very first few years of its use. If you total a car shortly after financing it your insurance company will compensate you for the value of the car which thanks to depreciation is often less than what you owe on the loan.

Hi All Please guide that how to record salary expense in quickbooks online. Download Weekly Expense Report Template - Excel. Each year you can claim a 10000 depreciation expense until the liquor license expires after ten years.

A new IRS rule the De Minimis Expense Threshold lets you deduct the entire cost of items less than 2500 as an expense instead of an asset. Yes with the DDD balance method the depreciation factor is 2x that of the SLD or Straight Line Depreciation method. No queues branch visits or lost documentation.

Instant Asset Write Off. There will be the value you can cash in by selling or trading it. An expense ratio is an annual fee charged to investors who own mutual funds and exchange-traded funds ETFs.

Whether your car and other business-related allowances count as a taxable income often. If the business use percentage is only 50. Guaranteed asset protection GAP insurance is less scammy than the previously mentioned coverage plans that dealers often push.

A fully depreciated car is one where the cars historical cost has already been allocated to expense except for the estimated salvage value if any. Our Asset Finance application portal is the first of its kind and couldnt be more convenient. Office supplies fall in the asset category but they are purchased for consumption meaning it can fall into an expense category.

Finally consider the opportunity cost of using your car to earn extra income. The Allstate Guaranteed Asset Protection GAP 1 program helps cover what you owe on your vehicle loan or lease if you experience a total loss before its paid off. The purpose of depreciation is to spread the expense and tax deductions of owning a business asset like a car or truck over the life of that asset.

A cell phone provided by an employer is generally considered a benefit that the employer can deduct as a necessary expense provided it is primarily used for business purposes. The company cannot depreciate more than the cars cost. Instead we can use the straight-line method to calculate amortization expense over the licenses 10-year term.

Generally the cost of the vehicle would have to be less than the relevant threshold. Under the simplified depreciation rules you depreciate improvements to assets. Get a new car loan and insurance approved in 12 hours.

You buy a vehicle for 30000 and use it 100 for business. The value is used to determine annual depreciation in. Under the instant asset write off rule you can immediately claim a small business tax write off for the cost of the business-use portion of the vehicle in the same year that you first used it.

Since its an asset you cant immediately claim a 100000 write off for the year you purchased the license. Leasing also streamlines writing off your vehicle as a business expense at tax time. Speed it up and move into fifth gear.

But a section 179 deduction allows you to take more of the expense of the purchase in. The actual wages tips and bonuses you receive for doing your job.

Is A Financed Vehicle An Asset Law Office Of Polly Tatum

Buying Real Estate Vs Buying A Car One Makes You Money The Other Takes It From You Pilieciproperties Helps You Bitcoin Generator Bitcoin Money Online

What Are Assets Why Should You Care Learning Centers Asset Money Management

Tips For Maintaining Your Company Car For Expense Control And Safety Car Dealer Car Lease Car Finance

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy Excel Spreadsheets Statement Template Balance Sheet

Accounting Basics Purchase Of Assets Accountingcoach

Mileage Log Template For Taxes Fresh Mileage Tracker Template Template Mileage Log Shee Spreadsheet Template Business Spreadsheet Business Spreadsheet Template

Flexclub Car Subscription Marketplace Expense Tracker App Customer Engagement Subscription

Is A Car An Asset Or A Liability Quora

:max_bytes(150000):strip_icc()/Just-what-factors-value-your-used-car_round2-debecdd740064e55b77979a734920925.png)

Just What Factors Into The Value Of Your Used Car

Always Invest Into Assets First You Can Buy A Car And Use Your Job To Pay For It Or You Can Save Money Management Advice Finance Investing Investing

Balance Sheet Template Are You Looking Or A Simple Balance Sheet Template In Ms Word Download This Balance Sh Balance Sheet Template Balance Sheet Templates

Leasing Business Concept With Icons About Contract Agreement Between Lessee And Sponsored Sponsored Paid Car Lease Contract Agreement Rental Solutions

Do Exceptional Infographic Design In A Affordable Price Ranking Your Freelancer Profile

Is A Car An Asset Or A Liability Quora

Most People See Huy Huynh S 2004 Honda Civic And They Think It S Just A Show Car But No This Em2 Is A Track Car First Th Honda Civic Ex Civic Ex

Yes Buying A New Car Makes More Sense Than Buying Used Wealthtender

/Familybuyingnewcar_skynesher_CROPPED_Eplus_Getty-2a8c993cd0c146da9cdcd5c293f766b2.jpg)